Fintech

May 3, 2024

There is considerable disagreement about the growth potential of AI. Francesco Filippucci, Peter Gal, Cecilia Jona-Lasinio, Alvaro Leandro and Giuseppe Nicoletti argue that the promises and perils of AI-related...

April 26, 2024

Innovative, integrated and independent retail payments are crucial components of our monetary system. As payments transition into the digital era, Piero Cipollone discusses taking the Single Euro Payments...

April 22, 2024

Cecilia Skingsley proposes a framework to help central bankers in embracing innovation and at the same time solve some of the challenges confronting the central banking and regulatory communities

April 16, 2024

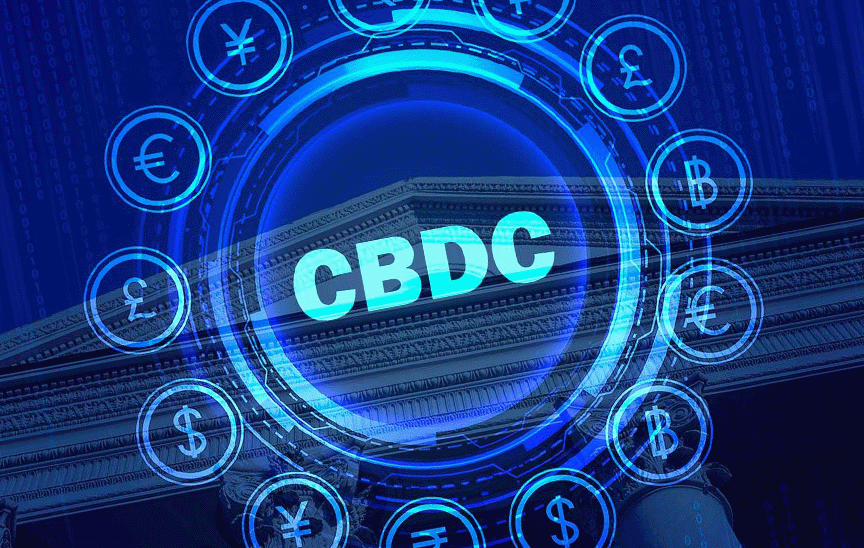

We are at a pivotal moment in the evolution of money. Eddie Yue says regulators must remain open-minded, responsive, and prudent when considering CBDCs

April 15, 2024

Amidst the prospect of significant technological change in payments, Sarah Breeden sets out how the Bank of England seeks to deliver trust and support innovation, both as a provider and as a regulator...

No posts found